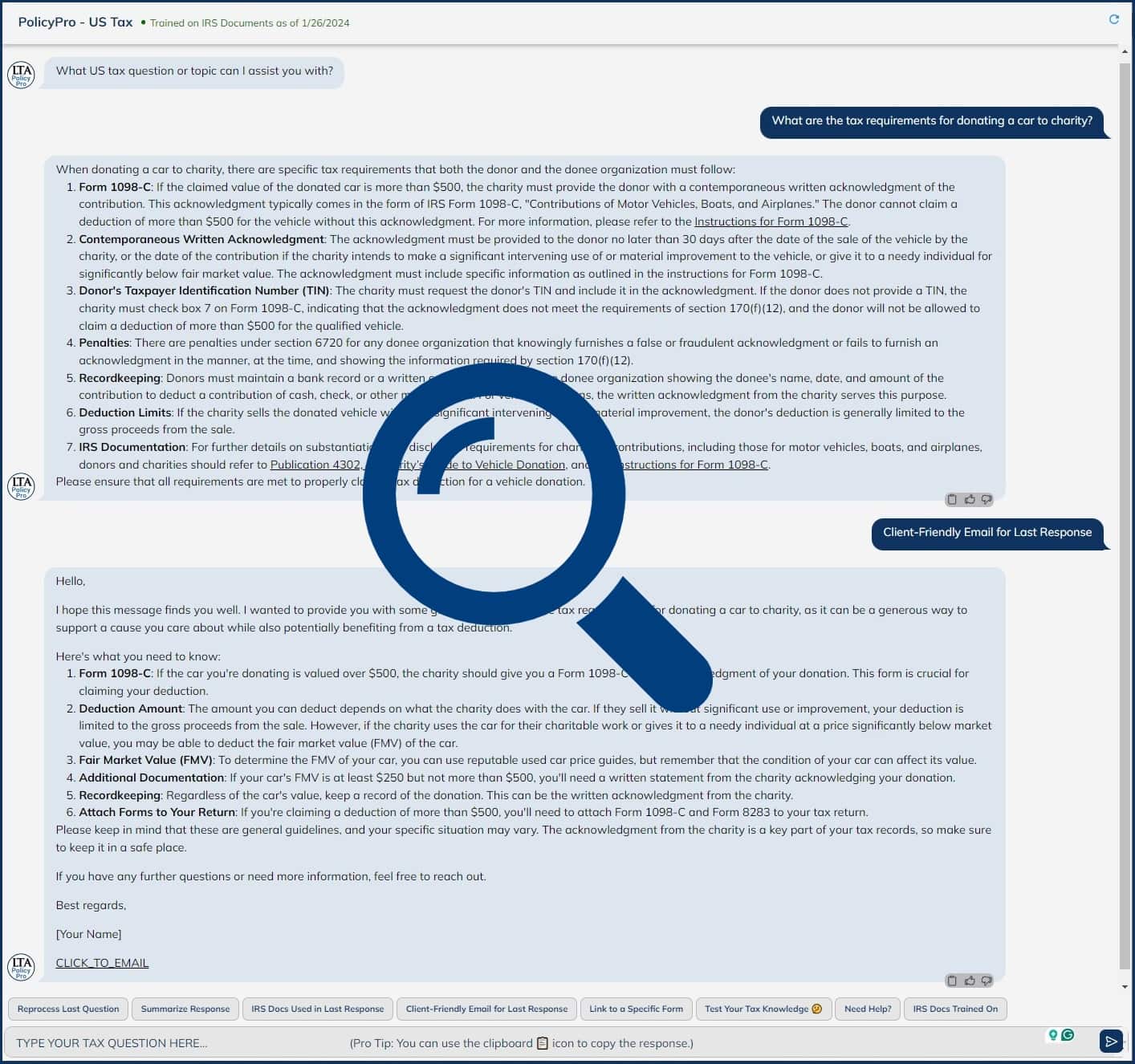

Explore Advanced Tax Research Capabilities Powered by OpenAI

Dependable AI tax guidance through a familiar conversational chatbot interface

Introducing the PolicyPro chatbot from LakeTurn Automation, a significant advancement in tax assistance technology. Engineered on a specialized private Language Learning Model (LLM) and rigorously trained with up-to-date IRS documentation. PolicyPro excels in providing accurate, internet-free answers to your tax questions; eliminating misinformation risks, and ensuring a trustworthy and efficient tax research experience.

Contact Us for a PolicyPro Test DriveIndex of IRS Data Powering LTA’s PolicyPro Chatbot

Explore our comprehensive training repository below – featuring over 350 IRS publications that power the knowledge base of our AI PolicyPro Assistant. This collection includes a wide range of tax codes, regulations, and guidance documents, each integral to our Language Learning Model (LLM). This deep training ensures our Policy Pro chatbot offers current, precise and authoritative tax assistance.

Foundational Training Materials

IRS Publications

Publication 15 (2024), (Circular E), Employer’s Tax Guide

Publication 1544 (09-2014), Reporting Cash Payments of Over $10,000

Publication 15-A (2024), Employer’s Supplemental Tax Guide

Publication 15-B (2023), Employer’s Tax Guide to Fringe Benefits

Publication 17 (2023), Your Federal Income Tax

Publication 225 (2023), Farmer’s Tax Guide

Publication 3 (2022), Armed Forces’ Tax Guide

Publication 334 (2022), Tax Guide for Small Business

Publication 3402 (03-2020), Taxation of Limited Liability Companies

Publication 463 (2022), Travel, Gift, and Car Expenses

Publication 501 (2023), Dependents, Standard Deduction, and Filing Information

Publication 502 (2023), Medical and Dental Expenses

Publication 503 (2023), Child and Dependent Care Expenses

Publication 504 (2023), Divorced or Separated Individuals

Publication 505 (2023), Tax Withholding and Estimated Tax

Publication 509 (2024), Tax Calendars

Publication 51 (2023), (Circular A), Agricultural Employer’s Tax Guide

Publication 510 (03-2023), Excise Taxes

Publication 514 (2022), Foreign Tax Credit for Individuals

Publication 517 (2023), Social Security and Other Information for Members of the Clergy

Publication 523 (2022), Selling Your Home

Publication 524 (2023), Credit for the Elderly or the Disabled

Publication 525 (2022), Taxable and Nontaxable Income

Publication 526 (2022), Charitable Contributions

Publication 527 (2022), Residential Rental Property

Publication 529 (12-2020), Miscellaneous Deductions

Publication 530 (2022), Tax Information for Homeowners

Publication 531 (12-2023), Reporting Tip Income

Publication 535 (2022), Business Expenses

Publication 536 (2022), Net Operating Losses (NOLs) for Individuals, Estates, and Trusts

Publication 537 (2023), Installment Sales

Publication 538 (01-2022), Accounting Periods and Methods

Publication 541 (03-2022), Partnerships

Publication 542 (01-2022), Corporations

Publication 544 (2022), Sales and Other Dispositions of Assets

Publication 547 (2022), Casualties, Disasters, and Thefts

Publication 550 (2022), Investment Income and Expenses

Publication 551 (12-2022), Basis of Assets

Publication 554 (2022), Tax Guide for Seniors

Publication 555 (03-2020), Community Property

Publication 557 (01-2023), Tax-Exempt Status for Your Organization

Publication 559 (2022), Survivors, Executors, and Administrators

Publication 560 (2022), Retirement Plans for Small Business

Publication 561 (01-2023), Determining the Value of Donated Property

Publication 571 (01-2023), Tax-Sheltered Annuity Plans (403(b) Plans)

Publication 575 (2022), Pension and Annuity Income

Publication 583 (01-2021), Starting a Business and Keeping Records

Publication 584-B (10-2017), Business Casualty, Disaster, and Theft Loss Workbook

Publication 587 (2022), Business Use of Your Home

Publication 590-A (2022), Contributions to Individual Retirement Arrangements (IRAs)

Publication 590-B (2022), Distributions from Individual Retirement Arrangements (IRAs)

Publication 596 (2023), Earned Income Credit (EIC)

Publication 721 (2023), Tax Guide to U.S. Civil Service Retirement Benefits

Publication 907 (2023), Tax Highlights for Persons With Disabilities

Publication 908 (02-2023), Bankruptcy Tax Guide

Publication 915 (2022), Social Security and Equivalent Railroad Retirement Benefits

Publication 925 (2022), Passive Activity and At-Risk Rules

Publication 926 (2024), Household Employer’s Tax Guide

Publication 929 (2021), Tax Rules for Children and Dependents

Publication 936 (2023), Home Mortgage Interest Deduction

Publication 938 (11-2023), Real Estate Mortgage Investment Conduits Reporting Information

Publication 939 (12-2022), General Rule for Pensions and Annuities

Publication 946 (2022), How To Depreciate Property

Publication 947 (02-2018), Practice Before the IRS and Power of Attorney

Publication 957 (01-2013), Reporting Back Pay and Special Wage Payments to the SSA

Publication 969 (2022), Health Savings Accounts and Other Tax-Favored Health Plans

Publication 970 (2022), Tax Benefits for Education

Publication 971 (12-2021), Innocent Spouse Relief

Publication 972 (2020), Child Tax Credit and Credit for Other Dependents

Publication 974 (2022), Premium Tax Credit (PTC)

IRS Form Instructions

General Instructions Information Returns (Forms 1097, 1098, 1099, 3921, 3922, 5498, & W-2G)

Instruction for Form 8955-SSA, Annual Reg Statement Separated Participants Vested Benefits

Instructions Forms 1099-MISC and 1099-NEC, Misc Income and Nonemployee Compensation

Instructions Form 1023, Application for Recognition of Exemption Under Section 501(c)(3)

Instructions Form 1023-EZ, Streamlined Application for Recognition of Exemption 501(c)(3)

Instructions Form 1024, Application for Recognition of Exemption Under Section 501(a) or 521

Instructions Form 1024-A, Application for Recognition of Exemption Under Section 501(c)(4)

Instructions Form 1028, Application for Recognition of Exemption Under Section 521

Instructions Form 1040 or Form 1040-SR, U.S. Individual Income Tax Return

Instructions Form 1040-SS, U.S. Self-Employment Tax Return (PR)

Instructions Form 1040-X, Amended U.S. Individual Income Tax Return

Instructions Form 1041, U.S. Income Tax Return for Estates & Trusts + Schedules A, B, G, J, & K-1

Instructions Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding

Instructions Form 1045, Application for Tentative Refund

Instructions Form 1065 (Schedule B-2), Election Out of Partnership Level Tax Treatment

Instructions Form 1065 Schedule M-3, Net Income (Loss) Reconciliation for Certain Partnerships

Instructions Form 1065, U.S. Return of Partnership Income

Instructions Form 1065-X, Amended Return or Administrative Adjustment Request (AAR)

Instructions Form 1066, U.S. Real Estate Mortgage Investment Conduit Income Tax Return

Instructions Form 1095-A, Health Insurance Marketplace Statement

Instructions Form 1097-BTC

Instructions Form 1098, Mortgage Interest Statement

Instructions Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes

Instructions Form 1098-F, Fines, Penalties and Other Amounts

Instructions Form 1098-Q, Qualifying Longevity Annuity Contract Information

Instructions Form 1099-B, Proceeds from Broker and Barter Exchange Transactions

Instructions Form 1099-CAP

Instructions Form 1099-DIV, Dividends and Distributions

Instructions Form 1099-G, Certain Government Payments

Instructions Form 1099-H, Health Coverage Tax Credit (HCTC) Advance Payments

Instructions Form 1099-K, Payment Card and Third Party Network Transactions

Instructions Form 1099-LS, Reportable Life Insurance Sale

Instructions Form 1099-LTC, Long Term Care and Accelerated Death Benefits

Instructions Form 1099-Q, Payments from Qualified Education Programs

Instructions Form 1099-S, Proceeds From Real Estate Transactions

Instructions Form 1099-SB, Seller’s Investment in Life Insurance Contract

Instructions Form 1120 REIT, U.S. Income Tax Return for Real Estate Investment Trusts

Instructions Form 1120, U.S. Corporation Income Tax Return

Instructions Form 1120-C, U.S. Income Tax Return for Cooperative Associations

Instructions Form 1120-H, U.S. Income Tax Return for Homeowners Associations

Instructions Form 1120-RIC, U.S. Income Tax Return For Regulated Investment Companies

Instructions Form 1120-S, U.S. Income Tax Return for an S Corporation

Instructions Form 1120-SF, U.S. Income Tax Return for Settlement Funds

Instructions Form 1125-E, Compensation of Officers

Instructions Form 1128, Application to Adopt, Change, or Retain a Tax Year

Instructions Form 1139, Corporation Application for Tentative Refund

Instructions Form 2106, Employee Business Expenses

Instructions Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts

Instructions Form 2210-F, Underpayment of Estimated Tax By Farmers and Fishermen

Instructions Form 2220, Underpayment of Estimated Tax by Corporations

Instructions Form 2290, Heavy Highway Vehicle Use Tax Return

Instructions Form 2441, Child and Dependent Care Expenses

Instructions Form 2553, Election by a Small Business Corporation

Instructions Form 2848, Power of Attorney and Declaration of Representative

Instructions Form 3115, Application for Change in Accounting Method

Instructions Form 3468, Investment Credit

Instructions Form 3800, General Business Credit

Instructions Form 3903, Moving Expenses

Instructions Form 4136, Credit For Federal Tax Paid On Fuels

Instructions Form 4255, Recapture of Investment Credit

Instructions Form 4562, Depreciation and Amortization (Including Info on Listed Property)

Instructions Form 461, Limitation on Business Losses

Instructions Form 4684, Casualties and Thefts

Instructions Form 4720, Return of Certain Excise Taxes Under Chapters 41 and 42

Instructions Form 4768, Application for Extension of Time To File a Return or Pay Estate Taxes

Instructions Form 4797, Sales of Business Property

Instructions Form 5227, Split-Interest Trust Information Return

Instructions Form 5300, Application for Determination for Employee Benefit Plan

Instructions Form 5307, Application for Determination for Adopters of Submitter Plans

Instructions Form 5310, Application for Determination Upon Termination

Instructions Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan

Instructions Form 5316, Application for Group or Pooled Trust Ruling

Instructions Form 5329, Additional Taxes on Qualified Plans and Other Tax-Favored Accounts

Instructions Form 5330, Return of Excise Taxes Related to Employee Benefit Plans

Instructions Form 5405, Repayment of the First-Time Homebuyer Credit

Instructions Form 5471, Information Return U.S. Persons With Respect to Certain Foreign Corps

Instructions Form 5498-ESA, Coverdell ESA Contribution Information

Instructions Form 56, Notice Concerning Fiduciary Relationship

Instructions Form 5695, Residential Energy Credit

Instructions Form 5884, Work Opportunity Credit

Instructions Form 5884-A, Employee Retention Credit

Instructions Form 6069, Return of Excise Taxes on Mine Operators, Black Lung Trusts, and Other

Instructions Form 6198, At-Risk Limitations

Instructions Form 6251, Alternative Minimum Tax – Individuals

Instructions Form 6478, Biofuel Producer Credit

Instructions Form 6627, Environmental Taxes

Instructions Form 6765, Credit for Increasing Research Activities

Instructions Form 7004, Application for Automatic Extension of Time To File Business Returns

Instructions Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return

Instructions Form 706-A, United States Additional Estate Tax Return

Instructions Form 706-GS(D), Generation-Skipping Transfer Tax Return for Distributions

Instructions Form 706-GS(D-1), Notification of Distribution From a Generation-Skipping Trust

Instructions Form 706-GS(T), Generation-Skipping Transfer Tax Return For Terminations

Instructions Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return

Instructions Form 706-QDT, U.S. Estate Tax Return for Qualified Domestic Trusts

Instructions Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return

Instructions Form 720, Quarterly Federal Excise Tax Return

Instructions Form 7203, S Corporation Shareholder Stock and Debt Basis Limitations

Instructions Form 7205, Energy Efficient Commercial Buildings Deduction

Instructions Form 7207, Advanced Manufacturing Production Credit

Instructions Form 8023, Elections Under Section 338 for Corps Making Qualified Stock Purchases

Instructions Form 8027, Employer’s Annual Information Return of Tip Income and Allocated Tips

Instructions Form 8038, Information Return for Tax-Exempt Private Activity Bond Issues

Instructions Form 8038-B, Information Return for Build America Bonds and Recovery Zone Bonds

Instructions Form 8038-CP, Return for Credit Payments to Issuers of Qualified Bonds

Instructions Form 8038-G, Information Return for Tax-Exempt Governmental Obligations

Instructions Form 8038-TC, Information Return for Tax Credit Bonds & Specified Tax Credit Bonds

Instructions Form 8082, Notice of Inconsistent Treatment or Administrative Adjustment Request

Instructions Form 8233, Exemption from Withholding on Compensation Nonresident Alien

Instructions Form 8275, Disclosure Statement

Instructions Form 8275-R, Regulation Disclosure Statement

Instructions Form 8283, Noncash Charitable Contributions

Instructions Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business

Instructions Form 8379, Injured Spouse Allocation

Instructions Form 843, Claim for Refund and Request for Abatement

Instructions Form 8582, Passive Activity Loss Limitations

Instructions Form 8582-CR, Passive Activity Credit Limitations

Instructions Form 8594, Asset Acquisition Statement Under Section 1060

Instructions Form 8606, Nondeductible IRAs

Instructions Form 8609, Low-Income Housing Credit Allocation and Certification

Instructions Form 8609-A, Annual Statement for Low-Income Housing Credit

Instructions Form 8615, Tax for Certain Children Who Have Unearned Income

Instructions Form 8697, Interest Computation – Look-Back Method for Long-Term Contracts

Instructions Form 8801, Credit for Prior Year Minimum Tax – Individuals, Estates, and Trusts

Instructions Form 8804-C, Certificate of Partner-Level Items to Reduce Section 1446 Withholding

Instructions Form 8804-W, Installment Payments of Section 1446 Tax for Partnerships

Instructions Form 8809-I, Application for Extension of Time to File FATCA Form 8966

Instructions Form 8810, Corporate Passive Activity Loss and Credit Limitations

Instructions Form 8814, Parents’ Election to Report Child’s Interest and Dividends

Instructions Form 8821, Tax Information Authorization

Instructions Form 8824, Like-Kind Exchanges

Instructions Form 8828, Recapture of Federal Mortgage Subsidy

Instructions Form 8829, Expenses for Business Use of Your Home

Instructions Form 8839, Qualified Adoption Expenses

Instructions Form 8844, Empowerment Zone Employment Credit

Instructions Form 8850, Pre-Screening Notice & Cert Request for the Work Opportunity Credit

Instructions Form 8853, Archer MSAs and Long-Term Care Insurance Contracts

Instructions Form 8854, Initial and Annual Expatriation Statement

Instructions Form 8857, Request for Innocent Spouse Relief

Instructions Form 8862, Information to Claim Earned Income Credit After Disallowance

Instructions Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits)

Instructions Form 8864, Biodiesel and Renewable Diesel Fuels Credit

Instructions Form 8866, Interest Computation Under the Look-Back Method for Property

Instructions Form 8867, Paid Preparer’s Due Diligence Checklist

Instructions Form 8868, Application for Extension of Time To File an Exempt Organization Return

Instructions Form 8869, Qualified Subchapter S Subsidiary Election

Instructions Form 8871, Political Organization Notice of Section 527 Status

Instructions Form 8872, Political Organization Report of Contributions and Expenditures

Instructions Form 8881, Credit for Small Employer Pension Plan Startup Costs & Enrollment

Instructions Form 8883, Asset Allocation Statement Under Section 338

Instructions Form 8885, Health Coverage Tax Credit

Instructions Form 8886, Reportable Transaction Disclosure Statement

Instructions Form 8886-T, Disclosure by Tax-Exempt Entity Regarding a Prohibited Tax Shelter

Instructions Form 8889, Health Savings Accounts (HSAs)

Instructions Form 8902, Alternative Tax on Qualifying Shipping Activities

Instructions Form 8903, Domestic Production Activities Deduction

Instructions Form 8908, Energy Efficient Home Credit

Instructions Form 8910, Alternative Motor Vehicle Credit

Instructions Form 8911, Alternative Fuel Vehicle Refueling Property Credit

Instructions Form 8912, Credit to Holders of Tax Credit Bonds

Instructions Form 8918, Material Advisor Disclosure Statement

Instructions Form 8928, Return of Certain Excise Taxes Under Chapter 43

Instructions Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit

Instructions Form 8936-A, Qualified Commercial Clean Vehicle Credit

Instructions Form 8937, Report of Organizational Actions Affecting Basis of Securities

Instructions Form 8940, Request for Miscellaneous Determination

Instructions Form 8941, Credit for Small Employer Health Insurance Premiums

Instructions Form 8949, Sales and other Dispositions of Capital Assets

Instructions Form 8950, Application for VCP Submission Under the EPCRS

Instructions Form 8952, Application for Voluntary Classification Settlement Program (VCSP)

Instructions Form 8959, Additional Medicare Tax

Instructions Form 8960, Net Investment Income Tax Individuals, Estates, and Trusts

Instructions Form 8962, Premium Tax Credit (PTC)

Instructions Form 8963, Report of Health Insurance Provider Information

Instructions Form 8971 (Inc. Schedule A), Beneficiaries Acquiring Property From a Decedent

Instructions Form 8973, Certified Professional Employer Org -Customer Reporting Agreement

Instructions Form 8974, Qualified Small Business Payroll Tax Credit for Increasing Research

Instructions Form 8978, Partner’s Additional Reporting Year Tax

Instructions Form 8979, Partnership Representative Revocation-Designation and Resignation

Instructions Form 8980, Partnership Request for Modification of Imputed Underpayments Under

Instructions Form 8985, Pass-Through Statement – Transmittal-Partnership Adjustment Tracking

Instructions Form 8986, Partner’s Share of Adjustment(s) to Partnership-Related Item(s)

Instructions Form 8990, Limitation on Business Interest Expense Under Section 163(j)

Instructions Form 8991, Tax on Base Erosion Payments of Taxpayers With Substantial Receipts

Instructions Form 8992, Global Intangible Low-Taxed Income (GILTI)

Instructions Form 8994, Employer Credit for Paid Family and Medical Leave

Instructions Form 8995, Qualified Business Income Deduction Simplified Computation

Instructions Form 8995-A, Qualified Business Income Deduction

Instructions Form 8996, Qualified Opportunity Fund

Instructions Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return

Instructions Form 941, Employer’s Quarterly Federal Tax Return

Instructions Form 941-SS, Employer’s Quarterly Federal Tax Return – Samoa, Guam & Virgin Island

Instructions Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund

Instructions Form 943, Employer’s Annual Federal Tax Return for Agricultural Employees

Instructions Form 943-A, Agricultural Employer’s Record of Federal Tax Liability

Instructions Form 943-X, Adjusted Employer’s Annual Federal Tax Return for Agricultural Emp.

Instructions Form 944, Employer’s Annual Federal Tax Return

Instructions Form 944-X, Adjusted Employer’s Annual Federal Tax Return or Claim for Refund

Instructions Form 945, Annual Return of Withheld Federal Income Tax

Instructions Form 945-A, Annual Record of Federal Tax Liability

Instructions Form 945-X, Adjusted Annual Return of Withheld Federal Income Tax or Refund

Instructions Form 9465, Installment Agreement Request

Instructions Form 965-A, Individual Report of Net 965 Tax Liability

Instructions Form 965-B, REIT Report of Net 965 Tax Liability and Electing REIT Report of 965

Instructions Form 965-C, Transfer Agreement Under Section 965(h)(3)

Instructions Form 965-E, Consent Agreement Under Section 965(i)(4)(D)

Instructions Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness

Instructions Form 990, Return of Organization Exempt From Income Tax

Instructions Form 990-EZ, Short Form Return of Organization Exempt From Income Tax

Instructions Form 990-PF, Return of Private Foundation or Trust Treated as Private Foundation

Instructions Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax)

Instructions Form CT-1, Employer’s Annual Railroad Retirement Tax Return

Instructions Form CT-1X, Adjusted Employer’s Annual Railroad Retirement Tax Return or Refund

Instructions Form SS-4, Application for Employer Identification Number (EIN)

Instructions Form SS-8, Determination of Worker Status regarding Federal Employment Taxes

Instructions Form W-12, IRS Paid Preparer Tax Identification Number Application and Renewal

Instructions Form W-7, Application for IRS Individual Taxpayer Identification Number

Instructions Form W-7-A, Application for TIN for Pending U.S. Adoptions

Instructions Form W-8BEN, Certificate of Status of Beneficial Owner for US Tax Withholding

Instructions Forms 1094-B and 1095-B

Instructions Forms 1094-C and 1095-C

Instructions Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement

Instructions Forms 1099-A and 1099-C, Acquisition/Abandonment of Property & Cancelled Debt

Instructions Forms 1099-INT and 1099-OID, Interest Income and Original Issue Discount

Instructions Forms 1099-QA and 5498-QA, Distributions and Contributions ABLE Accounts

Instructions Forms 1099-R and 5498, Distributions – Pensions, Annuities, Retirement, IRSA, etc.

Instructions Forms 1099-SA and 5498-SA, Distributions From an HSA, Archer MSA, etc.

Instructions Forms 3921 and 3922, Exercise of an Incentive Stock Option & Transfer ESOPs

Instructions Forms W-2 and W-3, Wage and Tax Statement & Transmittal of Wage and Tax Stmts.

Instructions Forms W-2G and 5754, Certain Gambling Winnings and Statement

Instructions on How to Apply for a Certificate of Subordination of Federal Tax Lien

Instructions on How to Apply for Certificate of Discharge from Federal Tax Lien

Instructions Preparing Administrative Claims for Damages Under Sections 7426, 7432, and 7433.

Instructions Preparing Notice of Nonjudicial Sale of Property and Application for Consent to Sale

Instructions Requesting a Certificate of Release of Federal Tax Lien

Instructions Schedule 6 (Form 8849), Other Claims

Instructions Schedule 8812, Credits for Qualifying Children and Other Dependents

Instructions Schedule A (Form 1040 or Form 1040-SR), Itemized Deductions

Instructions Schedule A (Form 8804), Penalty for Underpayment of Estimated 1446 Tax

Instructions Schedule A (Form 990 or Form 990-EZ), Public Charity Status and Public Support

Instructions Schedule B (Form 1040 or Form 1040-SR), Interest and Ordinary Dividends

Instructions Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors

Instructions Schedule C (Form 1040 or 1040-SR), Profit or Loss (Sole Proprietorship)

Instructions Schedule C (Form 1065), Additional Information for Schedule M-3 Filers

Instructions Schedule C (Form 1116), Foreign Tax Redeterminations

Instructions Schedule C (Form 1116), Foreign Tax Redeterminations – Copy

Instructions Schedule C (Form 990 or 990-EZ), Political Campaign and Lobbying Activities

Instructions Schedule D (Form 1040 or Form 1040-SR), Capital Gains and Losses

Instructions Schedule D (Form 1041), Capital Gains and Losses

Instructions Schedule D (Form 1065), Capital Gains and Losses

Instructions Schedule D (Form 1120), Capital Gains and Losses

Instructions Schedule D (Form 1120-S), Capital Gains and Losses and Built-In Gains

Instructions Schedule D (Form 941), Report of Discrepancies Caused by Acquisitions, Mergers

Instructions Schedule D (Form 990), Supplemental Financial Statements

Instructions Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss

Instructions Schedule F (Form 1040 or Form 1040-SR), Profit or Loss From Farming

Instructions Schedule F (Form 990), Statement of Activities Outside the U.S.

Instructions Schedule G (Form 990/990-EZ), Supplemental Info Regarding Fundraising or Gaming

Instructions Schedule H (Form 1040 or Form 1040-SR), Household Employment Taxes

Instructions Schedule H (Form 1120-F), Deductions Allocated To Effectively Connected Income

Instructions Schedule H (Form 990), Hospitals

Instructions Schedule I (Form 1041), Alternative Minimum Tax – Estates and Trusts

Instructions Schedule I (Form 1120-F), Interest Expense Allocation Under Section 1.882-5

Instructions Schedule J (Form 1040 or Form 1040-SR), Income Avg for Farmers and Fishermen

Instructions Schedule J (Form 1118), Adjustments to Separate Limitation Income (Loss) Instructions Schedule J (Form 990), Compensation Information

Instructions Schedule K (Form 990), Supplemental Information on Tax-Exempt Bonds

Instructions Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040

Instructions Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc.

Instructions Schedule K-1 (Form 1120-S), Shareholder’s Share of Income, Deductions, Credits, etc.

Instructions Schedule K-2 (Form 1120-S) and Schedule K-3 (Form 1120-S)

Instructions Schedule K-2 (Form 8865) and Schedule K-3 (Form 8865)

Instructions Schedule K-3 (Form 1065)

Instructions Schedule L (Form 1118), Foreign Tax Redetermination

Instructions Schedule L (Form 990 or 990-EZ), Transactions with Interested Persons

Instructions Schedule M-3 (Form 1120), Net Income (Loss) Reconciliation for $10M Corporations

Instructions Schedule M-3 (Form 1120-S), Net Income (Loss) Reconciliation for $10M S Corps

Instructions Schedule O (Form 1120), Consent Plan and Apportionment Sched Controlled Group

Instructions Schedule PH (Form 1120), U.S. Personal Holding Company (PHC) Tax

Instructions Schedule R (Form 1040 or Form 1040-SR), Credit for the Elderly or the Disabled

Instructions Schedule R (Form 941), Allocation Schedule for Aggregate Form 941 Filers

Instructions Schedule R (Form 943), Allocation Schedule for Aggregate Form 943 Filers

Instructions Schedule R (Form 990), Related Organizations and Unrelated Partnerships

Instructions Schedule S (Form 1120-F), Exclusion of Income from the Operation of Ships/Aircraft

Instructions Schedule SE (Form 1040 or Form 1040-SR), Self-Employment Tax

Instructions Schedule UTP (Form 1120), Uncertain Tax Position Statement

Instructions Schedule V (Form 1120-F), List of Vessels or Aircraft, Operators, and Owners

Instructions Schedules K-2 and K-3 (Form 1065)

Instructions the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY

Instructions the Requestor of Form W-9, Request for Taxpayer Identification Number

IRS Supplemental Instructions the Treasury FMS Interagency Agreement (IAA)

Shareholder’s Instructions Schedule K-3 (Form 1120-S), Shareholder’s Share of Income, etc.

Supplemental Form W-4 Instructions Nonresident Aliens

Adapting Our LLM to Your Firm’s Specific Needs

Our Custom AI Solutions

We start with our robust base of IRS training and use it to construct a Language Learning Model (LLM) specifically for your firm. To this, we can add any data you need – be it detailed tax law, strategic tax planning documentation, or proprietary compliance procedures. The result is a chatbot solution that not only knows IRS rules inside out but also understands your firm’s unique tax environment and operational processes.

Whether incorporating your internal tax policies, specific case studies, or unique compliance procedures, our adaptable LLM can be trained to understand and respond to the distinct characteristics of your firm’s tax landscape, providing a valuable, customized resource for your team’s tax-related queries and client delivery. Contact us today to learn more.